Table of Content

So if I have to choose I would dedicate myself to saving more for retirement, even if that means I would rent rather than own a house. Using our mortgage calculator, you enter your remaining loan balance of $200,000. To test the refi option, you shorten the mortgage term from your remaining 20 years to 15 years and drop your interest rate down a percentagefrom 4% to 3%.

Apparently, he doesnt have a credit score, since he eschews all credit. When you pay off your mortgage, you stop paying interest and lose the ability to write off that expense. For example, if you had been writing off $3,000 of loan interest a year and you pay 25 percent federal tax, your tax liability would go up by $750 if you pay off your loan. Its unclear what Churchills loan officers would say, but Im sure they offer other loan products, such as the 30-year fixed. Just make sure your monthly mortgage is never more than 25% of your monthly take-home pay. Make one extra payment each quarter to shave 11 years and nearly $65,000 off your mortgage.

Maximize Your Down Payment

You’ll also be spending a ton of money on your home, and your property will likely end up being your most valuable asset — if you make good choices about your home purchase. On the other hand, if things go wrong, it could lead to financial disaster. Getting preapproved for a mortgage is just the beginning.

This include providing basic contact info, at which point youll be matched up with a Home Loan Specialist. And theres a good chance many of his loyal listeners are in the same boat, yet dont have the money to pay all-cash for a home. While there is certainly this debate about paying off the mortgage vs. investing I do think there are some rules of thumb that I try to live by. By opting to go with a mortgage, you can give yourself more financial flexibility. Paying a mortgage can also provide tax benefits for homeowners who itemize deductions versus taking the standard deduction.

Who is Churchill Mortgage and how long have they been in business?

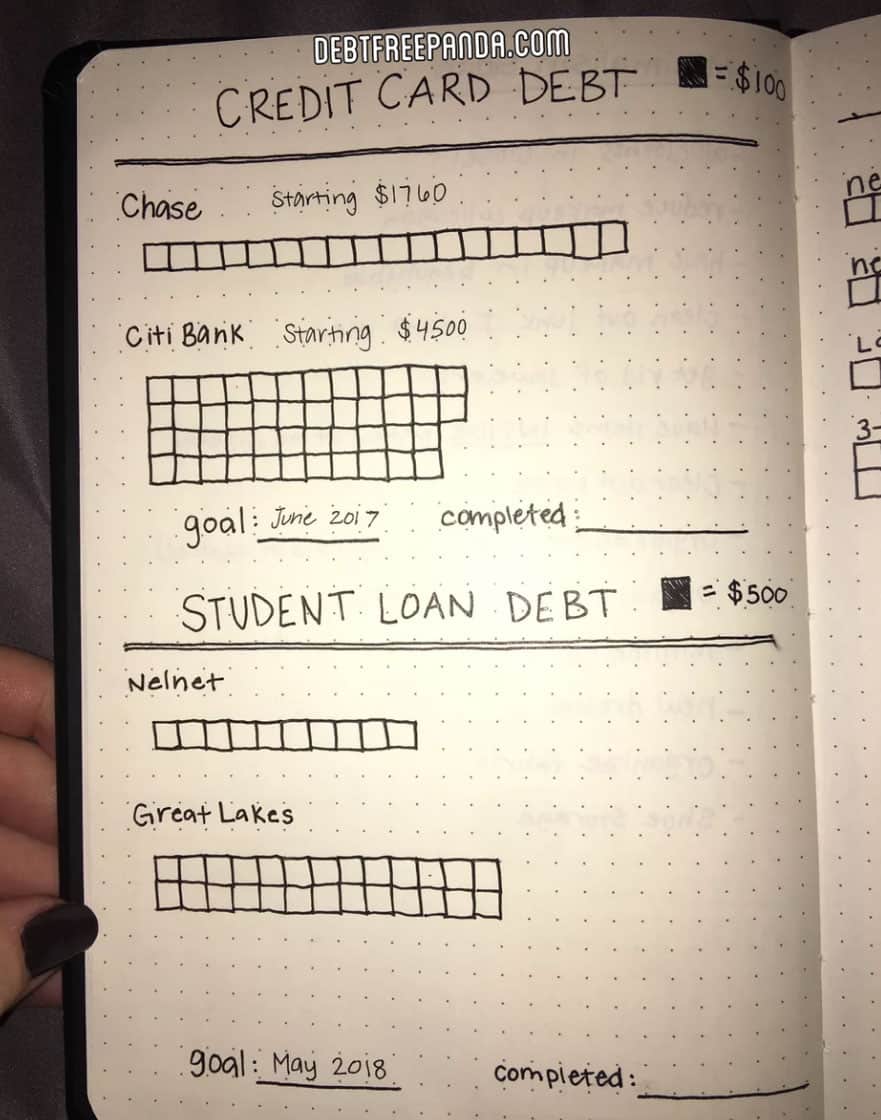

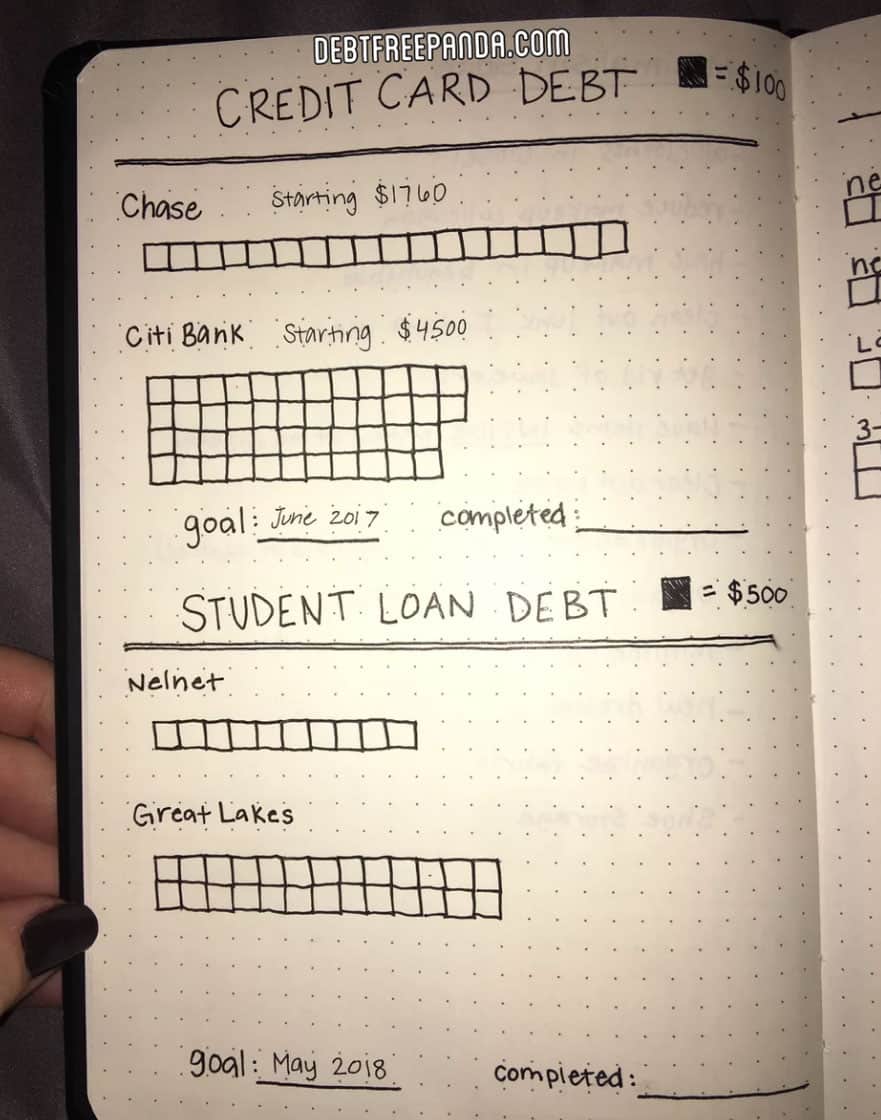

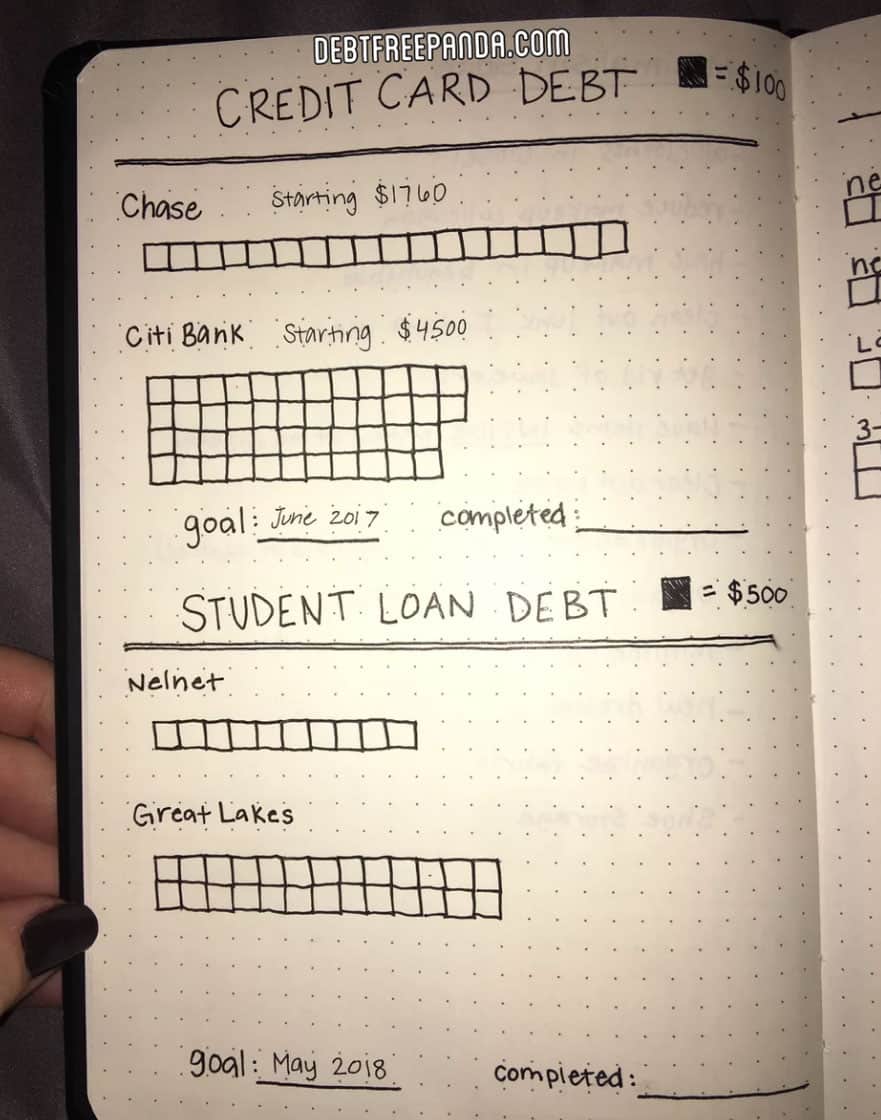

Do what you can to avoid taking on extra debt by making sure you have enough money to handle anticipated expenses. MOver time it will probably evolve into a less time-consuming budget tracking method, but it’s important to create a budget when you start. His followers become “gazelle focused” as they concentrate on debt repayment thanks to his utter loathing of debt.

The higher your down payment, the less interest you pay over the life of your home loan. The best way to pay for a home is with a 100% down payment in cash! Not only does it set you up for building wealth, but it also streamlines the real estate process.

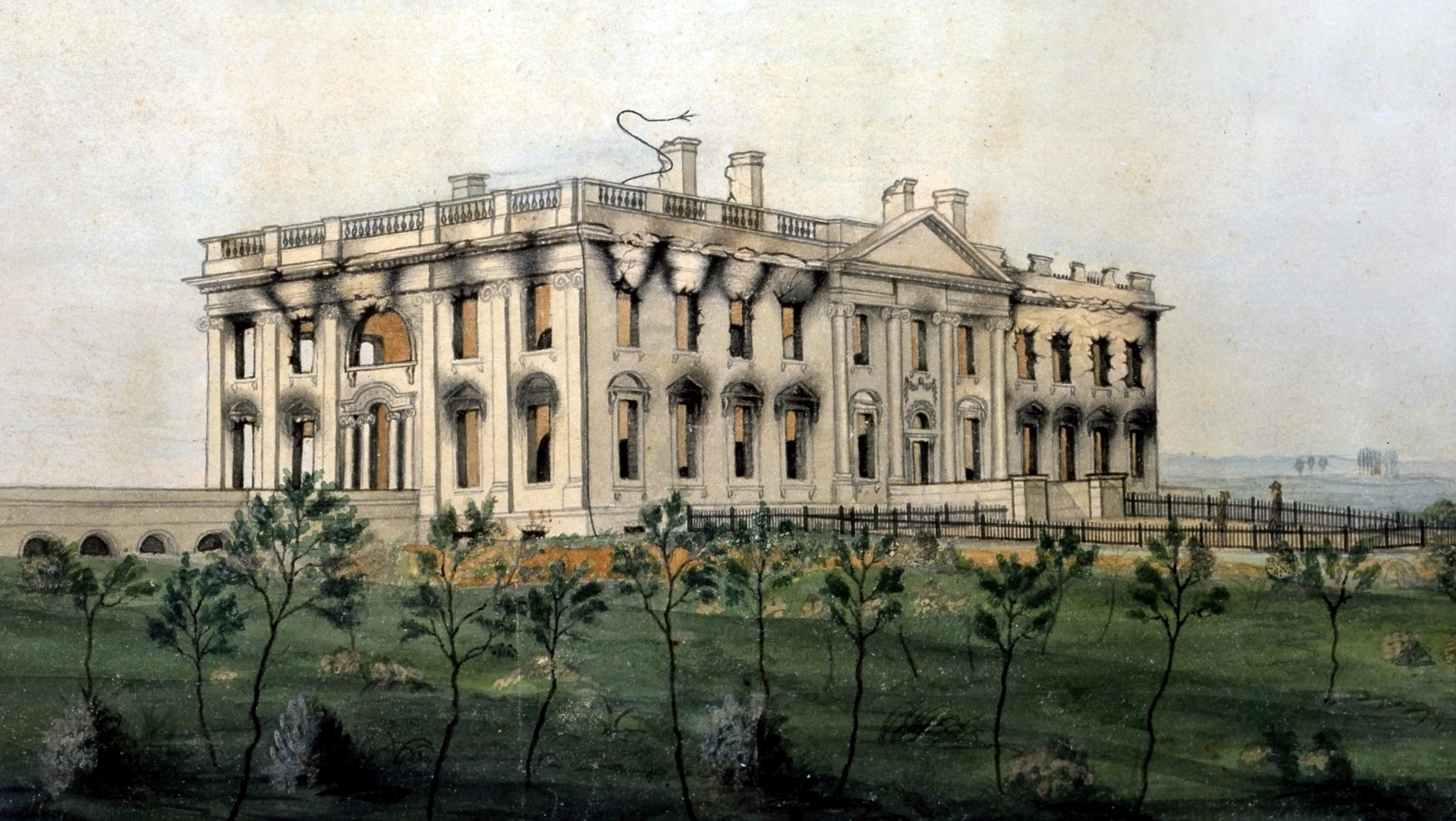

The History Of Churchill Mortgage

The information cannot be used by Churchill Mortgage to determine a customer's eligibility for a specific product or service. All financial calculators are provided by a third-party and are not controlled by or under the control of Churchill Mortgage. Churchill Mortgage is not responsible for the content, results, or the accuracy of information.

The Churchill Mortgage app is easy to navigate and keeps you up-to-date as key refinancing milestones are checked off. The right time to refinance looks different for everyone. So, take time to run the numbers with a Dave Ramsey Mortgage Expert and get your break-even analysis. You want to make sure it makes sense for you and your unique situation to refinance now. Once you know your estimated home affordability, you can start building your personalized home buying team.

Is Home Insurance Part Of Mortgage

Check with several competing lenders to make sure youre getting the best deal. Bottom line is, ARMs transfer the risk of rising interest rates to youthe homeowner. For over two decades, they have provided great service and the right tools to help borrowers achieve financial stability. Youd be saving more than 2% by locking in this crazy-low interest rate, and youre knocking the whole thing down to a 15-year loan. My husband and I are on Baby Step 2, and weve paid off about $30,000 in consumer debt since March.

I think a lot of us certainly want the dream home/McMansion that we see on TV but getting into our dream home can be a stretch for a lot of people. I would personally advise people to buy a much more modest house than try to stretch the budget to get into a bigger and better house. Buying a modest house, paying it off quickly, and then using that house to get into your dream home would probably be a better strategy. Second, save at least 15% of your income no matter what. If there is a choice between saving for retirement, saving for a house, and/or paying off the mortgage I will always err on the side of saving for retirement. Your house is an illiquid asset and unless you sell it it wont help you much in retirement if you dont have any savings.

In terms of approval, they say a 15-year fixed with at least 20% down provides the best chance of getting to the finish line. If Dave were calling the shots, hed probably say dont buy the house unless you can afford the 15-year fixed. I assume they offer all the most popular loan programs, but cant say so definitively. Its a bit bizarre that this information isnt readily available. One negative to Churchill is the lack of information regarding loan products.

In fact, this card is so good that our expert even uses it personally. Click here to read our full review for free and apply in just 2 minutes. If you commit to following a budget, you may be less likely to spend money on a whim.

Its definitely worth the extra $200 a month to make it happen. Doing that can really help to free up the burden you might be feeling right now if youre worried about when youll see your next paycheck. In 2019, the company originated more than $2.2 billion in home loans, a record year for Churchill Mortgage. With so much of your hard-earned money on the line, seek advice from a trusted home loan expert and have the confidence that you are in qualified hands.

Using this strategy, my sister and her husband are on target to pay off their mortgage before their sons graduate from high school. Ideally, you may use your kids’ middle and high school years to assist them financially prepare for college so they won’t need to take out loans. Ramsey suggests allocating extra dollars to steps five and six if you can contribute more than 15% to a savings goal. His starting point is 15% of his retirement savings in a balanced mutual fund portfolio.

It puts you even further away from completing either of those goals. You are able to pay the house off quicker and save money by skipping 15 years of interest. If you have a 30-year mortgage, then he recommends refinancing into a 15-year one as long as the new payment is not more than 25% of your take-home pay. Many or all of the products here are from our partners that pay us a commission.

No comments:

Post a Comment